We know that investments come with risk and the value of your investments can fall. With risk linked to potential rewards, it can be difficult to know how much risk is appropriate for you.

When we make financial decisions, lots of factors can influence what you decide. This may include emotional factors or bias, which can lead to you taking too much or too little risk for your circumstances So, how do you balance risk and reward when investing?

How are risk and reward linked?

As a general rule, the more risk you take the higher the potential returns. However, this comes with a higher risk of investment values falling and potentially losing your money.

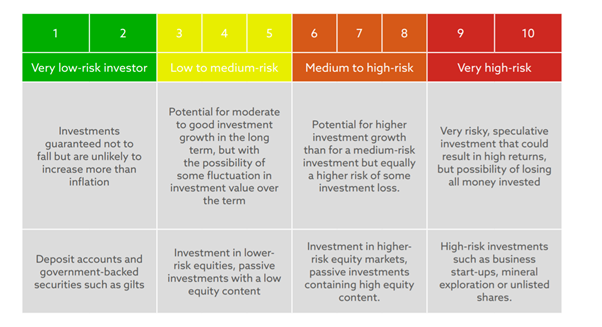

Investments are usually placed on a sliding scale of risk to show you where they fall. When you invest through a fund, for example, it will have a ‘risk rating’ to help you select investments that suit you. The table below shows how different investments may be categorised on a scale of one (lowest risk) to ten (highest risk).

While higher risk generally means higher potential returns, that doesn’t mean you should choose these investments. In many cases, a high-risk investment portfolio isn’t suitable for the average investor. Creating a risk profile can help you understand the level of risk that is appropriate for you.

What affects the level of risk you should take?

There’s no one size fits all solution to the level of risk you should take. It needs to consider you and your financial circumstances, including:

- Your investment goals. Your goal should be at the heart of your investment decisions. They can have a large impact on the level of risk you feel comfortable taking. If you’re investing for your child’s or grandchild’s future, you may want to take a more conservative approach. If, on the other hand, you’re investing to create extra income for a retirement that will already be comfortable, you may be willing to take more risk.

- The investment timeframe. As a general rule of thumb, the longer you plan to invest for, the greater amount of risk you can afford to take. So, if you’re starting your career and investing for retirement, you’re in a better position to take more risk. This is because over a longer timeframe there’s more opportunity to recover from dips in the market.

- The other assets you hold. You can’t consider investment risk without looking at your wider financial circumstances. If you’re taking a high level of risk with other assets, lower risk in your investment portfolio may make sense. In the same way that a portfolio needs to be balanced, so does the level of risk you’re taking across all your assets.

- Your capacity for loss. If the value of your investments were to fall, how would it impact your plans? If it could seriously affect your plans, a lower level of risk is likely to be advisable. If investments falling in value would leave you in a financially vulnerable position, you should look at alternatives first.

- Your overall attitude to risk. Finally, how you feel about investment risk is important. You need to feel comfortable with the investment decisions made. However, bias can have an impact and can lead to investors taking too much or too little risk. This is where a financial planner can help. We’re here to explain the options and why we recommend certain investments. With more information and someone to talk to, you can invest with confidence.

Remember the basics of investing

Whatever your risk profile, the basic lessons of investing still apply. Keep these three in mind when making investment decisions.

- Invest for long-term goals: If you have a short-term goal in mind, investing probably isn’t appropriate for you. Ideally, you should invest with a minimum five-year timeframe. This provides an opportunity to smooth out the peaks and troughs to hopefully deliver returns over the long term.

- Don’t focus on short-term fluctuations: It can be easy to focus on daily market movements, but it’s more important to look at the bigger picture. Focusing on the short-term movements can make it tempting to deviate from your plan by buying or selling. Instead, have faith in your long-term plan and remember, it’s time in the market not timing the market.

- Diversify: All investment portfolios should invest in a range of assets and sectors. This helps to spread the risk of your investments. When one area of your portfolio is performing poorly, another can help balance this. Even when your risk profile is ‘high’ diversifying is important.

If you’d like to talk to us about your risk profile, investments, and long-term financial plans, please get in touch.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.