Article posted: 23 December 2014

Mr Osborne made his mark with the Autumn Statement this month There were very few leaks about the Autumn Statement until the final days, when stories that the Treasury was considering an overhaul of stamp duty started to appear. It transpired that this time around the rumour mill was accurate.

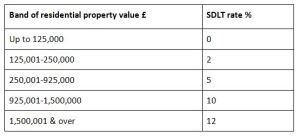

From 4 December, stamp duty land tax (SDLT) on residential property has been changed from the ‘slab’ approach – where an extra £1 of purchase price could add £40,000 to the tax bill – to a tiered, income tax style of approach, with each of five slices of value attracting a different rate (see table below). The end result is that 98% of homebuyers will pay less or the same amount in SDLT, while 2% – those buying properties valued at over £937,500 – will pay more. Ironically, given all the arguments about Scotland over recent months, the structure echoes the new land and buildings tax framework which the Scottish government recently announced and which takes effect north of the border in April 2015.

The new SDLT rates

Example

A property valued at £650,000 would be subject to stamp duty land tax of:

£0 – £125,000 @ 0% = £0

£125,000 – £250,000 @ 2% = £2,500

£250,000 – £650,000 @5% = £20,000

Total £22,500

Under the old slab SDLT regime, a flat rate of 4% would have applied to the whole value, giving a tax bill of £26,000.

Revamping SDLT will add £760 million to the government borrowing in the coming year, a large part of the £1 billion ‘giveaway’ in the Autumn Statement. To be fair to the Chancellor, the old SDLT system had few defenders: it had been described as “a strong contender for the UK’s worst-designed tax”, a title for which there is considerable competition. Quite what the impact of the reform will be on the housing market will be interesting to see.

Economic theory suggests that homebuyers will not alter their total outlay on a new abode, which is a combination of property price, SDLT and other (unchanged) costs. Thus, if the SDLT element goes down, the property price should rise – and vice versa (mainly in London). Indeed, for £1.5 million plus properties negotiating a lower purchase price now comes with the added benefit of reducing the value tier subject to 12% SDLT.

Tax laws can change. The Financial Conduct Authority does not regulate tax advice.