Article posted on 14 October 2014

HMRC have published details of ISA investments for the last tax year and they tell a strange story.

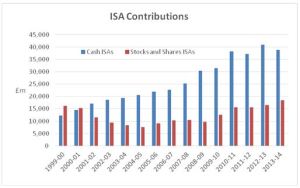

ISAs, which became NISAs on 1 July 2014, have long been popular with savers, as the graph below demonstrates.

What is surprising is the heavy bias towards cash ISAs, despite the miserable, often sub-inflation, interest rates that have prevailed in recent years. While the amount invested in stocks and shares ISAs is not much increased from the level in the year ISAs were born, cash ISA contributions have more than tripled. However, in 2013/14 the new contributions to cash ISAs fell by about 5% and the number of contributors dropped by about 10%. Stocks and shares ISAs saw corresponding increases of 12% and 2%.

This might be a sign that ISA savers are growing more aware of the smallness of cash ISA tax benefits. Take, for example, the National Savings & Investments Direct NISA, which has one of the top instant access rates at 1.5%. Invest the maximum in 2014/15 of £15,000 – more than double last tax year’s maximum – and, if you are a higher rate taxpayer, your annual tax saving is just £90. The same amount invested in a stocks and shares NISA holding a typical corporate bond fund yielding 3.5% gives a tax saving of £210.

One of the arguments for not choosing a stocks and shares ISA used to be that it was impossible to switch a cash ISA at a later date (although the opposite move was available). Since the arrival of NISAs on 1 July 2014, transfers between cash and stocks and shares have been possible in either direction.

If you hold cash NISAs, there are two things to do now:

- Check the interest rates you are being paid. Providers have been cutting NISA rates of late and if you have a chart-topping NISA from a few years ago, you could find it is now paying no more than 0.5%.

- Talk to us about your NISA options. It may be better for you to pay tax on deposit interest and shelter your investment income and gains in a NISA.

The value of tax reliefs depends on your individual circumstances. Tax laws can change. The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances.